Are you looking to diversify your crypto investment portfolio? It’s a wise move, considering the volatile nature of the cryptocurrency market. In this article, you will find valuable tips and tricks to help you effectively diversify your investments and minimize risks. From spreading your investments across different cryptocurrencies to exploring various investment strategies, we will guide you through the process of building a diversified crypto investment portfolio. So, if you’re ready to take your crypto investments to the next level, let’s get started!

Choose a Variety of Cryptocurrencies

When creating your crypto investment portfolio, it’s important to choose a variety of cryptocurrencies. Researching different cryptocurrencies will give you a better understanding of their features and potential for growth. Consider factors such as the technology behind the cryptocurrency, the team behind its development, and any unique selling points it may have.

Another factor to consider is the market cap size of each cryptocurrency. Market cap is calculated by multiplying the current price per coin by the total supply of coins. Cryptocurrencies with larger market caps are generally considered more stable and less prone to volatility. However, smaller cap cryptocurrencies may have greater growth potential, so it’s essential to strike a balance between stability and potential.

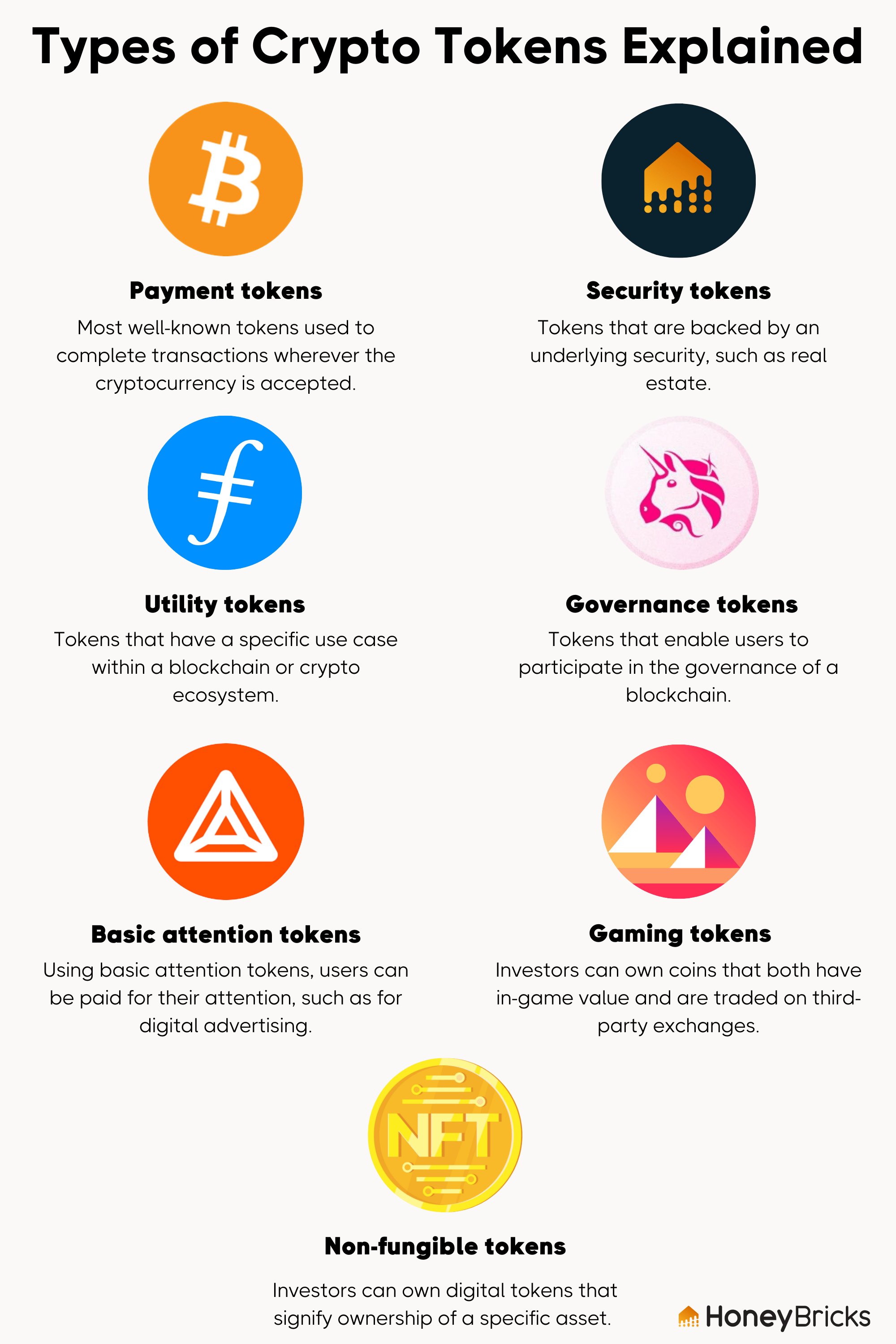

In addition to considering individual cryptocurrencies, it’s crucial to diversify across different categories of coins. This means allocating funds across various types of cryptocurrencies, such as privacy coins, utility tokens, and stablecoins. Diversifying your investment across different categories can help mitigate risks and capture potential growth opportunities in different sectors of the crypto market.

Allocate Funds Wisely

Once you have selected a variety of cryptocurrencies, it’s important to allocate your funds wisely. Setting a budget for your crypto investments is a crucial step in managing your portfolio effectively. Determine how much money you can afford to invest without jeopardizing your financial stability. It’s essential to remember that cryptocurrencies are highly volatile, and investing more than you can afford to lose is never advisable.

Consider your risk tolerance when allocating funds across different cryptocurrencies. Some cryptocurrencies may have higher risks but also higher potential rewards, while others may have lower risks but more modest returns. Assess your comfort level with risk and adjust your allocation accordingly. Striking a balance between high-risk and low-risk investments can help you optimize your portfolio’s performance.

Consider Long-Term vs Short-Term Investments

Before allocating your funds, it’s important to differentiate between your long-term and short-term investment goals. Long-term investments are typically held for an extended period, often years, with the goal of capitalizing on the cryptocurrency’s potential growth over time. Short-term investments, on the other hand, are intended to capture short-term price movements or take advantage of specific market conditions.

Allocate your funds across different cryptocurrencies based on your investment goals. For long-term investments, consider allocating more funds to cryptocurrencies with strong fundamentals and long-term growth potential. For short-term investments, focus on cryptocurrencies that are experiencing positive market trends or have upcoming events that could affect their price.

Consider holding periods when managing your portfolio. Some cryptocurrencies may require longer holding periods to realize their potential. Others may be better suited for short-term trading. Understanding the holding periods associated with different cryptocurrencies can help you make informed decisions about when to buy or sell.

Diversify Across Exchanges

Diversifying across cryptocurrency exchanges is another essential aspect of portfolio management. Choose multiple cryptocurrency exchanges to spread your risk. Different exchanges can offer different features, trading pairs, and liquidity. By using multiple exchanges, you can take advantage of various opportunities and ensure you have access to a wide range of cryptocurrencies.

When choosing exchanges, consider the level of liquidity they provide. High liquidity ensures that there are enough buyers and sellers in the market, making it easier to execute trades at desired prices. Exchanges with high liquidity are also less prone to price manipulation. By diversifying exchanges and selecting those with high liquidity, you reduce the risk of experiencing difficulties in buying or selling your cryptocurrencies.

Spreading the risk of exchange hacks is another advantage of diversifying across exchanges. If one exchange experiences a security breach or gets hacked, having funds on other exchanges will reduce the impact on your overall portfolio. Maintaining accounts on multiple exchanges and not keeping all your cryptocurrencies in one place is a proactive measure to protect your investments.

Include Stablecoins in Your Portfolio

Stablecoins can play an important role in your crypto investment portfolio. Stablecoins are cryptocurrencies that are pegged to a stable asset, such as a fiat currency like the US dollar. They offer stability during periods of high market volatility and can act as temporary safe havens for your funds.

By including stablecoins in your portfolio, you can maintain stability during market downturns. When the value of other cryptocurrencies is declining, stablecoins remain relatively constant in value. This can help reduce the overall volatility of your portfolio and provide a more predictable investment option.

It’s important to understand the role and purpose of stablecoins before incorporating them into your portfolio. Different stablecoins may have varying mechanisms for maintaining price stability, such as utilizing collateral or algorithmic algorithms. Research and choose stablecoins that align with your investment objectives and provide confidence in their stability.

Monitor Market Trends and News

To effectively manage and optimize your crypto investment portfolio, it’s crucial to stay updated with crypto news and follow market trends and analysis. Market trends can provide valuable insights into the sentiment and direction of the market, helping you make informed decisions about your investments.

Stay updated with crypto news by following reputable sources of information such as crypto-focused websites, industry blogs, and news outlets. Pay attention to events and announcements that could impact the price and adoption of cryptocurrencies. This includes regulatory developments, partnerships, major technological advancements, and market trends.

In addition to news, monitoring market trends and analysis can help you identify patterns and make strategic investment decisions. Technical analysis, which involves studying historical price and volume data, can provide insights into potential future price movements. Fundamental analysis, on the other hand, focuses on evaluating the underlying value and potential growth of cryptocurrencies.

Reacting to market changes is essential for maintaining a well-performing portfolio. Keep an eye on market trends, news, and analysis, and adjust your investment strategy accordingly. This could involve rebalancing your portfolio, adjusting your allocation, or taking advantage of favorable market conditions.

Consider the Correlation Between Cryptocurrencies

Understanding the correlation between different cryptocurrencies is crucial for effective portfolio diversification. Correlation refers to the relationship between the price movements of two or more assets. By diversifying among lowly correlated assets, you can reduce the risk of your portfolio being heavily impacted by the price fluctuation of a single cryptocurrency.

Diversification across lowly correlated assets means including cryptocurrencies that are influenced by different market forces. For example, if you have cryptocurrencies that are primarily influenced by developments in the decentralized finance (DeFi) sector, consider including cryptocurrencies that are more influenced by gaming or privacy-focused sectors. This way, even if one sector experiences a downturn, other sectors may still perform well, providing balance to your portfolio.

Avoid overlapping investments by considering the correlation between different cryptocurrencies in your portfolio. Overlapping investments, where multiple cryptocurrencies move in similar directions, can increase your exposure to particular sectors or market factors. By diversifying across lowly correlated cryptocurrencies, you can reduce this overlap and spread your risk more effectively.

Assess Risk and Reward Ratio

Evaluating the risk and reward ratio of each cryptocurrency is essential for making informed investment decisions. Assessing the risk factors involves considering the underlying technology, the team behind the cryptocurrency, potential regulatory hurdles, and any other risks specific to the cryptocurrency. Understanding and evaluating these risks can help you gauge the potential downside of your investments.

Assessing the potential rewards involves analyzing the growth potential, market demand, and adoption prospects of each cryptocurrency. Look for cryptocurrencies with strong fundamentals, technological innovation, and a clear use case that addresses real-world problems. Evaluate the potential return on investment and compare it to the associated risks.

Optimize your risk and reward ratio by striking a balance between high-risk, high-reward investments, and lower-risk, more stable options. Allocate your funds across cryptocurrencies with varying levels of risk and potential rewards to create a well-rounded portfolio. This ensures that you have exposure to both growth opportunities and more stable assets.

Implement Dollar-Cost Averaging

Dollar-cost averaging is a strategy that allows you to invest fixed amounts regularly, regardless of the cryptocurrency’s price. This strategy is particularly useful in volatile markets, as it reduces the impact of price fluctuations on your portfolio. By investing fixed amounts at regular intervals, you buy more of a cryptocurrency when prices are low and less when prices are high.

Understand the concept of dollar-cost averaging and its benefits before implementing it in your portfolio. It helps you avoid emotional decision-making based on short-term price movements and encourages a disciplined approach to investing. This strategy ensures that you are consistently investing in the market, regardless of short-term price fluctuations.

By implementing dollar-cost averaging, you can take advantage of market downturns by buying more of a cryptocurrency at lower prices. Over time, this can lower the average cost of your investments, potentially increasing your overall returns when the market recovers.

Rebalance Your Portfolio Periodically

Monitoring your portfolio’s performance is crucial to maintaining a well-diversified and optimized investment strategy. Periodically evaluate your portfolio’s performance against your investment objectives and adjust your asset allocation accordingly.

Regularly reassess your portfolio’s asset allocation to ensure it aligns with your risk tolerance and investment goals. Consider whether any specific cryptocurrencies have overperformed or underperformed compared to your expectations. Adjust your allocation to maintain your desired level of risk and take advantage of new investment opportunities.

Maintaining portfolio allocation targets is essential for consistent and disciplined portfolio management. As the value of different cryptocurrencies fluctuates, your initial allocation may shift. Rebalancing involves selling or buying assets to realign your portfolio with your target allocation. This ensures that you continue to adhere to your investment strategy in a changing market environment.

In conclusion, building and managing a crypto investment portfolio requires careful consideration of various factors. By choosing a variety of cryptocurrencies, allocating funds wisely, considering investment goals, diversifying across exchanges, including stablecoins, monitoring market trends, assessing correlation between cryptocurrencies, evaluating risk and reward ratio, implementing dollar-cost averaging, and rebalancing your portfolio periodically, you can create a well-diversified and optimized crypto investment portfolio. Remember to stay informed, make informed decisions, and adjust your strategy as needed to achieve your investment objectives.