Imagine you have ventured into the exciting world of crypto trading, where the potential for profits is vast. However, amidst the thrill of navigating the ups and downs of the market, one aspect that often gets overlooked is taxes. Yes, taxes! But don’t worry, this article is here to guide you on how to effectively manage taxes in crypto trading. So, get ready to learn about the importance of reporting your earnings, understanding taxable events, and utilizing the right tools to keep track of all your transactions. Get ready to turn your crypto trading into a tax-savvy endeavor!

Understanding Crypto Taxes

What are crypto taxes?

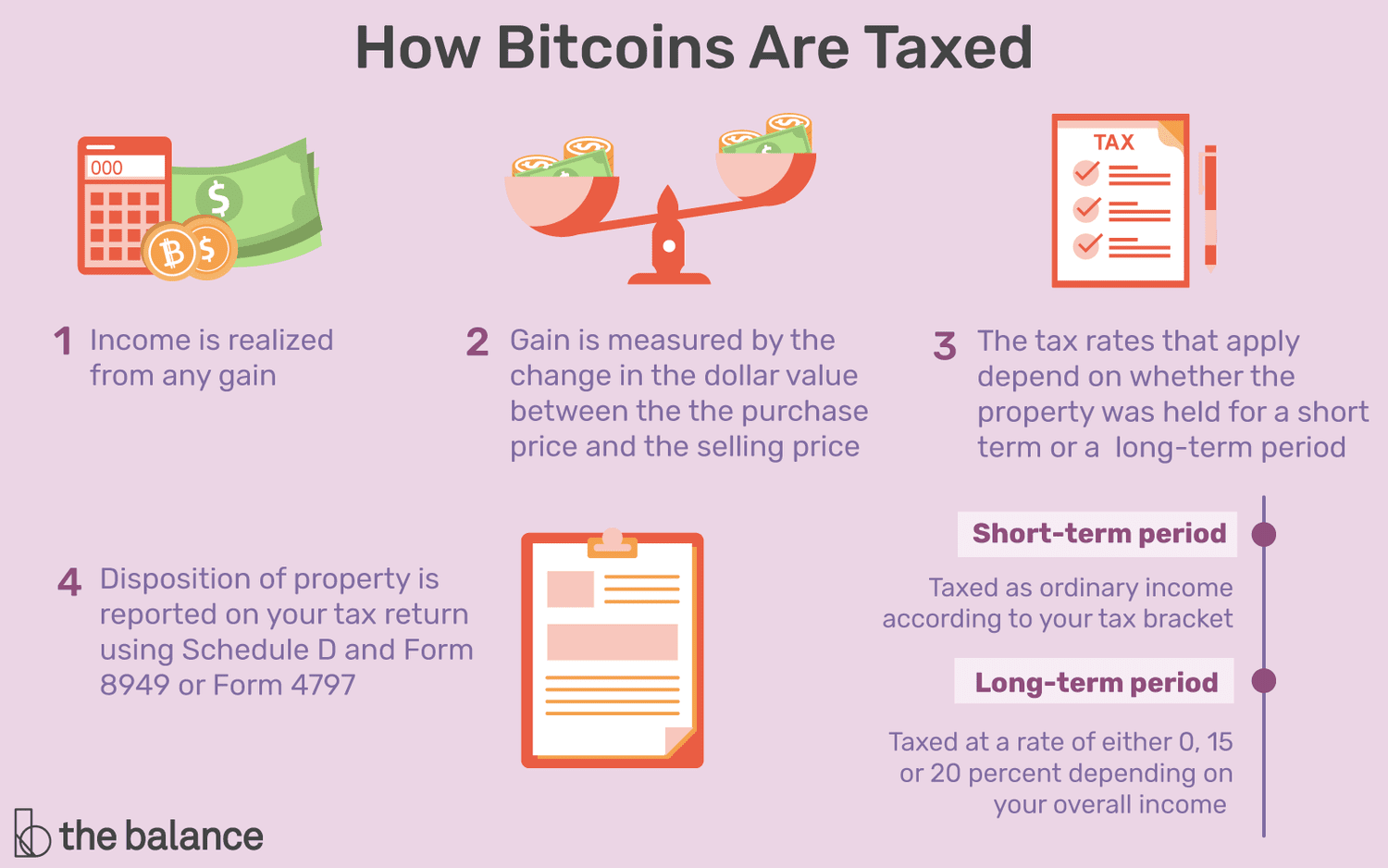

Crypto taxes refer to the taxes that individuals or businesses who participate in cryptocurrency trading must pay to the government. Just like any other financial asset or investment, cryptocurrencies are subject to taxation as they generate income or capital gains.

Why do crypto traders have to pay taxes?

Crypto traders have to pay taxes because cryptocurrencies, such as Bitcoin and Ethereum, are considered property by the tax authorities. When you buy, sell, or trade cryptocurrencies, you incur taxable events that trigger tax liabilities. These tax liabilities are essential for funding government services and maintaining the economy.

Different types of taxes in crypto trading

There are different types of taxes that crypto traders may encounter in their trading activities. The most common taxes include:

- Capital Gains Tax: This tax applies when you sell or exchange cryptocurrencies for a profit. The capital gains tax rate depends on the holding period of the asset.

- Income Tax: If you receive cryptocurrency as payment for goods or services, it is considered income and subject to income tax.

- Gift Tax: When you gift cryptocurrencies to someone else, it may be subject to gift tax if it exceeds the annual gift tax exclusion limit.

- Mining Tax: If you engage in cryptocurrency mining activities, the rewards you receive may be subject to income or self-employment taxes.

1. Taxation Guidelines for Cryptocurrency

Tax regulations for crypto trading

Tax regulations for crypto trading vary by country and jurisdiction. It is essential to understand your local tax laws regarding cryptocurrencies. Some countries treat cryptocurrencies as assets subject to capital gains tax, while others may view them as currency subject to income tax. Familiarize yourself with the specific regulations in your region to ensure compliance.

Tax liabilities based on holding period

The tax liabilities associated with cryptocurrencies can vary based on the holding period of the asset. Short-term capital gains tax applies to assets held for less than one year, while long-term capital gains tax applies to assets held for more than one year. Typically, long-term capital gains tax rates are more favorable and can result in lower tax liabilities.

Taxable events in crypto trading

In crypto trading, taxable events refer to specific actions that trigger tax obligations. The following are common taxable events in crypto trading:

- Selling or exchanging cryptocurrencies.

- Using cryptocurrencies to purchase goods or services.

- Receiving cryptocurrencies as payment for work or services.

- Mining cryptocurrencies and receiving mining rewards.

- Receiving airdrops or participating in forks.

2. Tracking Crypto Transactions

The importance of keeping accurate records

Keeping accurate records of all your crypto transactions is crucial for correctly calculating your tax liabilities. It is essential to maintain detailed records of the date, time, and value of each transaction, as well as the parties involved. Accurate records will help you track your cost basis, calculate gains or losses, and fulfill your reporting requirements.

Using cryptocurrency tax software

To simplify the process of tracking and calculating your crypto transactions, you can utilize cryptocurrency tax software. These software solutions integrate with cryptocurrency exchanges and wallets to automatically import your transaction data. They can also generate comprehensive reports and calculate your tax liabilities based on your local regulations.

Maintaining a transaction log

In addition to using tax software, it’s beneficial to maintain a transaction log to record any additional information not captured by the software. This log can include details such as transaction purposes, transaction fees, and specific addresses used. Having a comprehensive transaction log will provide additional documentation and support for accurate tax reporting.

3. Calculating Capital Gains and Losses

Determining the cost basis

The cost basis of your cryptocurrencies refers to the original purchase price plus any applicable fees or expenses. It is crucial to determine the cost basis accurately to calculate your capital gains or losses correctly. The cost basis will vary for each transaction, depending on the date and price of acquisition.

Calculating capital gains and losses

To calculate your capital gains or losses from crypto trading, you need to subtract the cost basis of the cryptocurrencies you sold from the proceeds of the sale. If the result is positive, it represents a capital gain, while a negative result indicates a capital loss. These gains or losses are reported on your tax return and determine your tax liabilities.

Dealing with wash sales

Wash sales occur when you sell a cryptocurrency at a loss and repurchase the same or substantially similar cryptocurrency within a short period. For tax purposes, wash sales are not deductible, meaning you cannot use the loss to offset other gains. It is crucial to track and report wash sales accurately to avoid any issues with the tax authorities.

4. Reporting Crypto Taxes

Filing requirements for crypto traders

As a crypto trader, it is essential to understand your filing requirements for reporting your taxes accurately. In most countries, if you exceed certain thresholds, such as a specified number of transactions or certain income levels, you may need to report your crypto activities on specific tax forms. Failure to comply with filing requirements can result in penalties and audits.

Forms and schedules for reporting

Depending on your jurisdiction, you may need to use specific tax forms or schedules to report your crypto activities. Commonly used forms include Schedule D (Capital Gains and Losses), Form 8949 (Sales and Other Dispositions of Capital Assets), and Form 1040 (U.S. Individual Income Tax Return). Consult your local tax authority or a tax professional to determine the appropriate forms for your situation.

Preventing tax evasion and penalties

It is essential to report your crypto taxes accurately to avoid the risk of tax evasion and potential penalties. The tax authorities are increasingly focusing on crypto transactions, and non-compliance can lead to severe consequences. By keeping detailed records, using tax software, and consulting with professionals when necessary, you can ensure you meet your tax obligations and avoid any legal issues.

5. Deductible Expenses in Crypto Trading

Understanding deductible expenses

Deductible expenses in crypto trading refer to the costs incurred in the process of buying, selling, and holding cryptocurrencies that can be subtracted from your taxable income. Some common deductible expenses include transaction fees, commissions, and expenses related to maintaining a cryptocurrency wallet or exchange account. It is essential to keep track of these expenses and include them when calculating your tax liability.

Expenses related to mining

If you participate in cryptocurrency mining, you may be eligible to deduct certain expenses associated with your mining activities. These expenses can include the cost of mining equipment, electricity expenses, internet costs, and any other expenses directly related to mining operations. Consult with a tax professional to determine which expenses qualify for deduction in your jurisdiction.

Costs of trading platforms and services

If you utilize cryptocurrency trading platforms or services, the expenses associated with those platforms or services may be deductible. This can include subscription fees, transaction fees, and fees for accessing advanced trading features. Keep accurate records of these expenses and consult with a tax advisor to determine their deductibility.

6. Tracking Airdrops and Forks

Tax implications of airdrops and forks

Airdrops and forks in the cryptocurrency world can have tax implications. When you receive free cryptocurrency tokens through an airdrop or as a result of a fork, it may be considered taxable income. The value of the received tokens at the time of the airdrop or fork is subject to income tax, and you should report it accordingly.

Valuing and reporting airdrops and forks

To determine the taxable value of the received tokens from airdrops or forks, you should use the fair market value at the time of the event. The fair market value can typically be obtained from reputable cryptocurrency exchanges or other reliable sources. It is crucial to report the received tokens accurately on your tax return to ensure compliance.

Navigating hard forks and tax liabilities

Hard forks, which result in the creation of a new cryptocurrency, can present complexities when it comes to tax liabilities. In general, if you receive new tokens as a result of a hard fork, it is treated as taxable income. The cost basis of these new tokens will be their fair market value at the time of receipt, and any subsequent gains or losses will be subject to capital gains tax when you sell or exchange them.

7. Dealing with Cryptocurrency Gifts

Gift tax rules for cryptocurrency

When gifting cryptocurrencies, it is crucial to understand the gift tax rules and regulations in your jurisdiction. Cryptocurrency gifts are subject to gift tax if they exceed the annual gift tax exclusion limit. The gift tax rates and thresholds may vary, so consult with a tax professional to ensure compliance.

Proper documentation for gifted coins

To properly document gifted coins for tax purposes, it is essential to keep records of the date, value, and recipient of the gift. Both the giver and the receiver should maintain this information, as it may be required for tax reporting purposes. By documenting the gifted coins accurately, you can ensure transparency and compliance with tax regulations.

Reporting and paying taxes on gifted coins

When you gift cryptocurrency to someone else, the recipient is generally not responsible for paying taxes on the gifted coins. However, the giver may be subject to gift tax if the value of the gift exceeds the annual exclusion limit. The giver should report the gift on their tax return and pay any applicable gift tax based on their local regulations.

8. Tax Strategies for Crypto Traders

Tax loss harvesting

Tax loss harvesting is a strategy where you intentionally sell cryptocurrencies at a loss to offset capital gains and reduce your overall tax liability. By harvesting losses, you can generate tax deductions that could be used to offset other taxable income or gains. Consult with a tax professional to understand the rules and limitations of tax loss harvesting in your jurisdiction.

Holding periods for long-term gains

One effective tax strategy for crypto traders is to hold cryptocurrencies for more than one year to qualify for long-term capital gains tax rates. Long-term capital gains tax rates tend to be lower than short-term rates, resulting in potential tax savings. However, holding periods should be evaluated based on market conditions and investment goals.

Maximizing deductions and credits

To minimize your tax liability as a crypto trader, it is essential to maximize your deductions and utilize any available tax credits. Deductible expenses, as discussed earlier, should be carefully tracked and included when calculating your taxable income. Additionally, explore any tax credits that may be applicable to your situation, such as renewable energy credits for mining activities or foreign tax credits for international trading.

10. Seeking Professional Help

When to consult a tax professional

Given the complexities and evolving nature of cryptocurrency taxation, it is advisable to seek professional help when necessary. If you have significant trading activity, complex transactions, or are unsure about your tax obligations, consulting a tax professional with expertise in cryptocurrencies can provide valuable guidance and ensure compliance with tax laws.

Choosing a tax advisor with crypto expertise

When selecting a tax advisor, it is essential to choose someone with experience and expertise in cryptocurrency taxation. Look for professionals who understand the intricacies of crypto trading, are familiar with the tax regulations in your jurisdiction, and stay up-to-date with the latest developments in crypto tax laws. A knowledgeable tax advisor can help optimize your tax planning and ensure accurate reporting.

The benefits of professional tax guidance

Seeking professional tax guidance for your crypto trading activities offers several benefits. A tax professional can help you navigate the complexities of crypto taxation, maximize your deductions, minimize your tax liability, and ensure compliance with local regulations. They can also provide peace of mind, knowing that your taxes are being handled properly and effectively.

In conclusion, understanding and managing taxes in crypto trading is crucial to ensure compliance with tax laws and avoid potential penalties. By familiarizing yourself with the tax regulations, keeping detailed records, utilizing tax software, and seeking professional guidance when necessary, you can navigate the crypto tax landscape with confidence and optimize your tax position. Remember, staying informed and proactive is key to effectively managing crypto taxes and maximizing your financial outcomes.